This week Mesa’s bond rating agency reports were released by S&P and Moody’s, two of the three largest credit rating agencies.

It’s been a while since I’ve written anything on the financial health of Mesa and I feel like now would be an appropriate time. If you don’t follow finances or understand accounting, I would be glad to meet and explain further in person, 480-648-3756, if you have any questions or concerns.

The most relevant thing I want to outline in this article is that we not only have a fiduciary responsibility for the city of Mesa (as a municipality), but ultimately our primary responsibility is for the future welfare of all 500,000 people residing here. It is extremely important that we draw a distinction between the two because what looks good at the city level is a lot of the time detrimental to the people who live in Mesa. This is mainly due to higher taxes and utilities to cover the ever-increasing costs.

Good for Mesa Bad for Taxpayers and Utility Customers

Let me explain by giving a few examples of what I’m referring to. As the City’s financial situation becomes worse due to its increased spending, the bond rating agencies would normally lower Mesa’s credit rating. To prevent this from occurring, the city must raise additional revenue to replenish their funds and cover their operating costs. There are five ways the city can accomplish this: 1) neglect the investment in infrastructure (capital improvement projects), 2) amortize the debt over a longer time period, 3) create new debts (bonds), 4) increase utility rates, and 5) increase sales tax (as a percentage). We have done all five, here are some examples:

Lack of Investment in Critical Infrastructure

In the above example, you can see that over $3.2 billion is anticipated to be invested in our Mesa over the next 8 years. What you should also take away from this is the City anticipates asking the voters for approximately $1.1 billion dollars of more debt which will appear on the 2020 ballot.

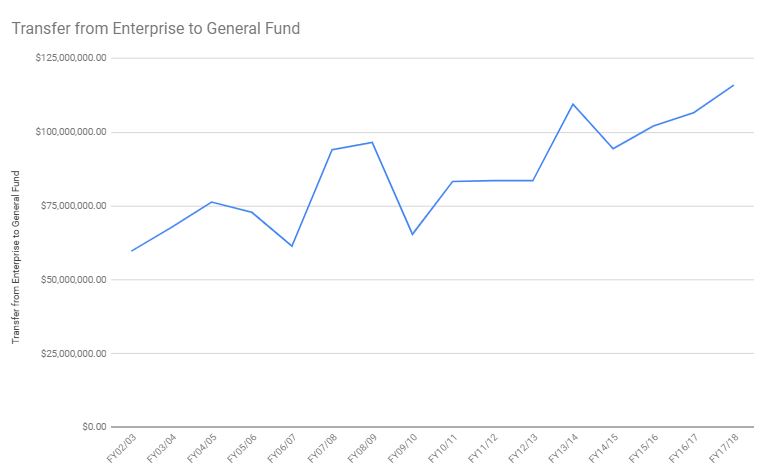

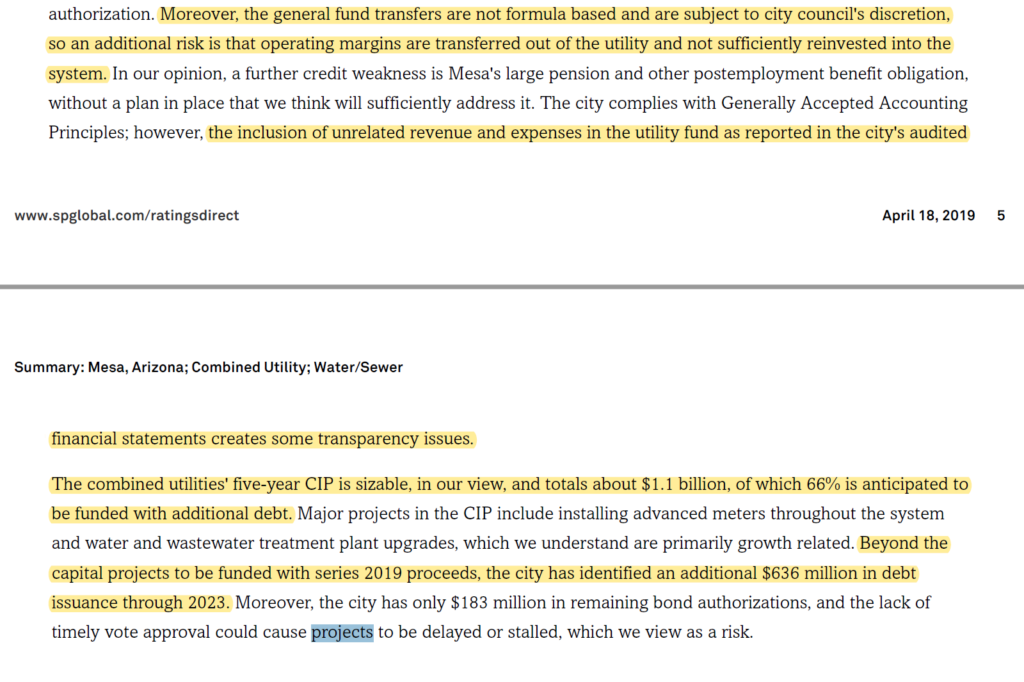

Now if we look at the above projections we only have around $370 million. To be exact it is estimated that we are short $2,857,835,493. If you can’t count that many commas that is $2.8 billion dollars. The main cause of this neglect is due to the massive transfer of utility revenue from the enterprise fund, to the general fund, where it can be used for discretionary spending. Instead, utility revenue should be reinvested in critical infrastructure. Failing to invest utility revenue in repairing, maintaining, and upgrading the utility system is extremely destabilizing and will ultimately lead to 1) massive amounts of capital needed in the form of debt (paid by taxpayers), or 2) the deterioration of the utility system (example to follow).

The increase for the transfers can be seen year over year below:

Here is the relevant excerpt from the bond rating reports. I am proposing we do exactly what the bond rating agency reports suggest and cap on the amount of money the city is permitted to transfer out of the enterprise fund and into the general fund for discretionary spending.

Organizations and companies don’t normally function this way

This quote is from this year’s credit rating report, in which the credit rating agencies recognize this as a problem. In a normal functioning organization or corporation, capital assets are depreciated over a long time period to determine how much money should be held in reserves to pay for these investments. However, the city uses its utility system to leverage a massive amount of debt to ultimately transfer utility revenues to the general fund to be spent on discretionary items. The goal is to load up the system with debt rather than address the ever-increasing expenditures.

Holding voters hostage

I refer to utility bonds as, “holding voters hostage”. I felt this way when I ultimately had to vote to approve them this month. You will constantly hear the argument that we have debt because voters approved it. Of course voters are going to approve bonds for clean water and infrastructure, who in their right mind wouldn’t. The main problem is that the money being generated from the Mesa utility enterprise and its debts is not being reinvested in utility infrastructure and instead is being siphoned off in the amount of 30% every year.

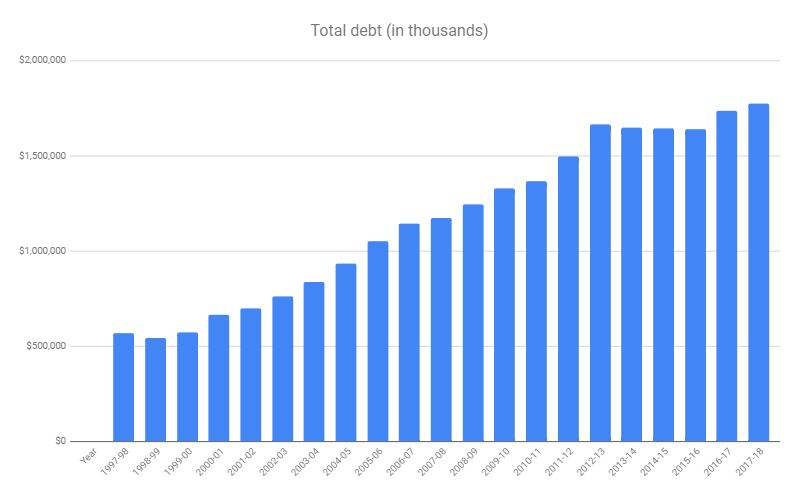

$2 Billion in debt

Mesa’s debt over the last 20 years has increased by approximately 205%. In the next few years, we will break the $2 billion dollar debt figure. The politicians have shown a level of irresponsibility with the City’s budget as outlined by these massive debt increases and utility rate increases.

From 1998 to 2008 the City of Mesa has increased its debt, on average, 5.97%, annually. Now let’s assume we increase our debt year over year at the same percentage. This assumes a baseline of 2019 indexed to 100, more information can be found on indexing here,

https://www.dallasfed.org/research/basics/indexing.aspx . Here is what the future projections show. This amount of debt is wildly unsustainable.

When you run out of money amortize your liabilities

The other issue hurting Mesa’s financial stability is Mesa’s pension liability. Instead of addressing the pension liability problems head-on, Mesa has decided to not address the problem and let someone else deal with it in the future. Mesa has amortized our PSPRS liabilities from 20 years to 30 years using a 25-year pay off schedule.

Outlined in the chart below is the massive pending pension crisis, totaling almost $600 million in unfunded liabilities:

This issue is also outlined in the bond rating reports.

Luckily we’re a monopoly…

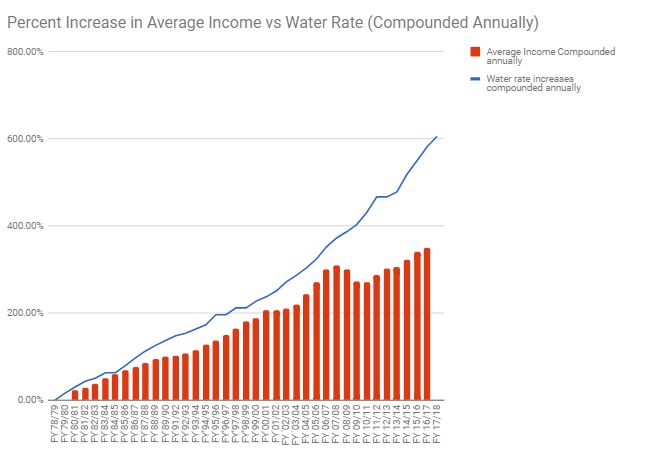

It is important to remember the bond rating agencies have one concern: to protect the investor. They do not care about the future sustainability of our citizens. This is an extremely important distinction that needs to be made. While these reports are essential to analyzing the fiscal health of our municipality they bear no burden on the future sustainability of our city, or the wealth of our residents. In fact, you could argue the opposite is true. They recognize we are a monopoly and we can, and have, continuously increased taxes and utilities to pay these liabilities. Utility rate increases are a regressive inflationary tax impacting the poor and middle class disproportionately. These quotes below are from this year’s report.

This chart below shows the runaway inflation costs of water vs. the average income in Mesa:

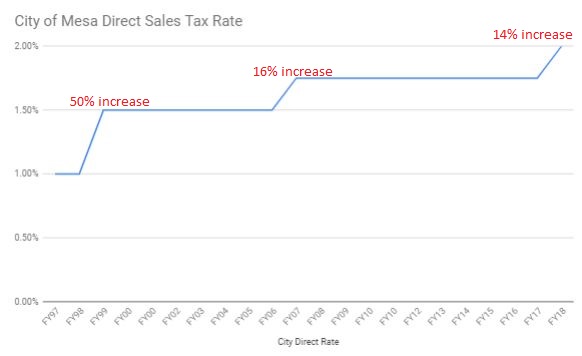

Massive Sales Tax Increases

The above chart is another example of a major problem instead of solving the spending issues we continuously burden the tax-payer. This chart shows that on average we increase the sales tax by 5% every year. One percent in 1998 to two percent in 2018 is a 100% increase over the duration of 20-years or 5% every year. Here’s what this looks like over the next 80 years.

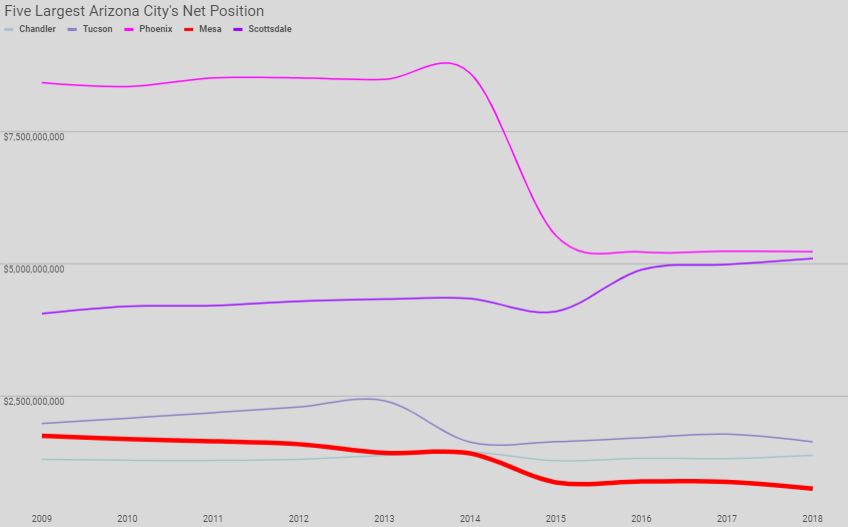

Mesa’s Eroding Wealth

There is one chart that summarizes the overall health of the municipality and that is the net position. This takes all of your assets and subtracts your liabilities. It’s the equivalent of an individual’s net worth. The chart below shows the comparison of Mesa’s net position compared to the five largest cities in the state. While we rank third in size on this chart we come in last as it pertains to wealth.

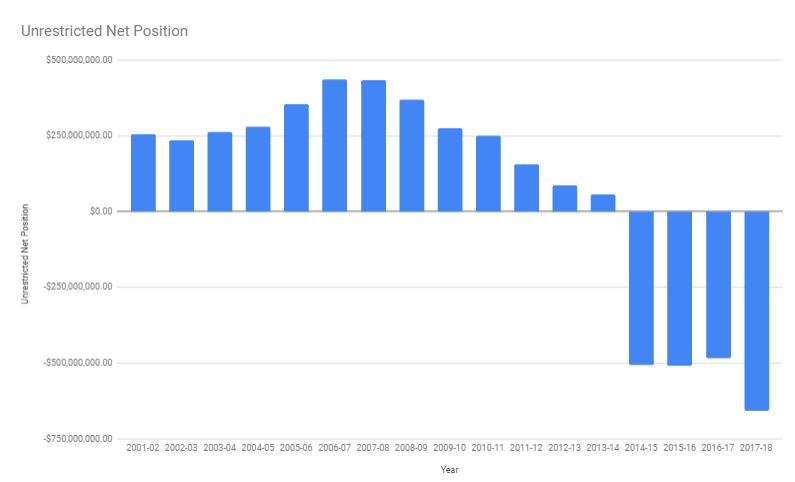

What’s worse is a city has assets that it cannot sell. Like street asphalt, lights, restrict funds, etc. If you remove these assets, our wealth plummets into insolvency. This can be found in our unrestricted net position. Our wealth is negative $658 million.

Government spending whether through debt financing or direct taxes takes money from the private sector. This will continuously lower our living standards and damage our economy.

Insolvency

It is important to note that this is not an issue of liquidity in which you can just keep issuing more debt/bonds. The issue is one of insolvency. The people of Mesa are the revenue source for the city. You can only take so much of their annual income before they have nothing left to give. As we start to see a huge rise in homelessness, we need to ask ourselves the question, “what is the cause?” I would say it’s simple. Picture yours or an average individuals income as a pie chart. As utilities, government taxes, rent, mortgage, etc. keep going up, the average individual is not seeing increases in pay – this becomes unsustainable and begins stressing the entire system. For a more in-depth macroeconomic view of this topic, I would recommend, “Big Debt Crises, by Ray Dalio”.

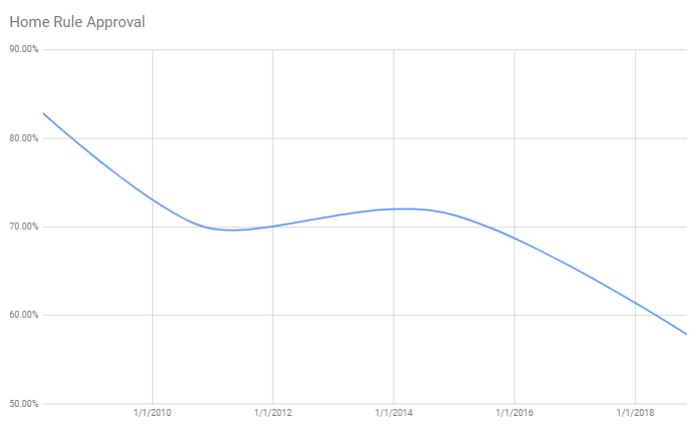

Home Rule Approval plummets

Home Rule gives the City of Mesa the ability to control our own budget as opposed to having state-mandated limits on our spending. It appears the people of Mesa are becoming wise as “Home Rule” approval has plummeted over the last two elections. It fell from 83% approval in 2008 to 71% in 2014. In the last election it fell an additional 14% from 72% to 58%. Losing home rule would mean massive budget cuts. Instead, we should pass a charter amendment to limit the transfers from the enterprise fund to the general fund at 20%. The alternative would be a lot more difficult to manage.

In Summary

Mesa’s wealth is your wealth, collectively. You should exercise extreme caution when politicians tell you that spending more money through bonds and debt financing is the path to wealth. It is, in fact, the exact opposite. Debt is an extremely powerful tool that can be used to disguise today’s problems while burdening future citizens of Mesa with these liabilities if it’s not used properly. We should invest Mesa tax and utility revenues in maintaining and repairing our aging infrastructure and addressing our pension obligations. Only after Mesa has addressed these long term issues should Mesa tax and utility revenues be used for any discretionary projects. Amortization of liabilities sets a dangerous trap that our kids will have to deal with it when it’s snowballed into a massive debt that will be too big to pay back. Be cautious of people who simply regurgitate bond rating agency reports without actually digesting them.

References:

S&P Utility Revenue_Mesa_AZ_Combined_Utility_2019

Moody’s – UtilityRevenue_Mesa, AZ_2019

S&P GO Mesa_AZ Rating Report_2019

UPDATE: